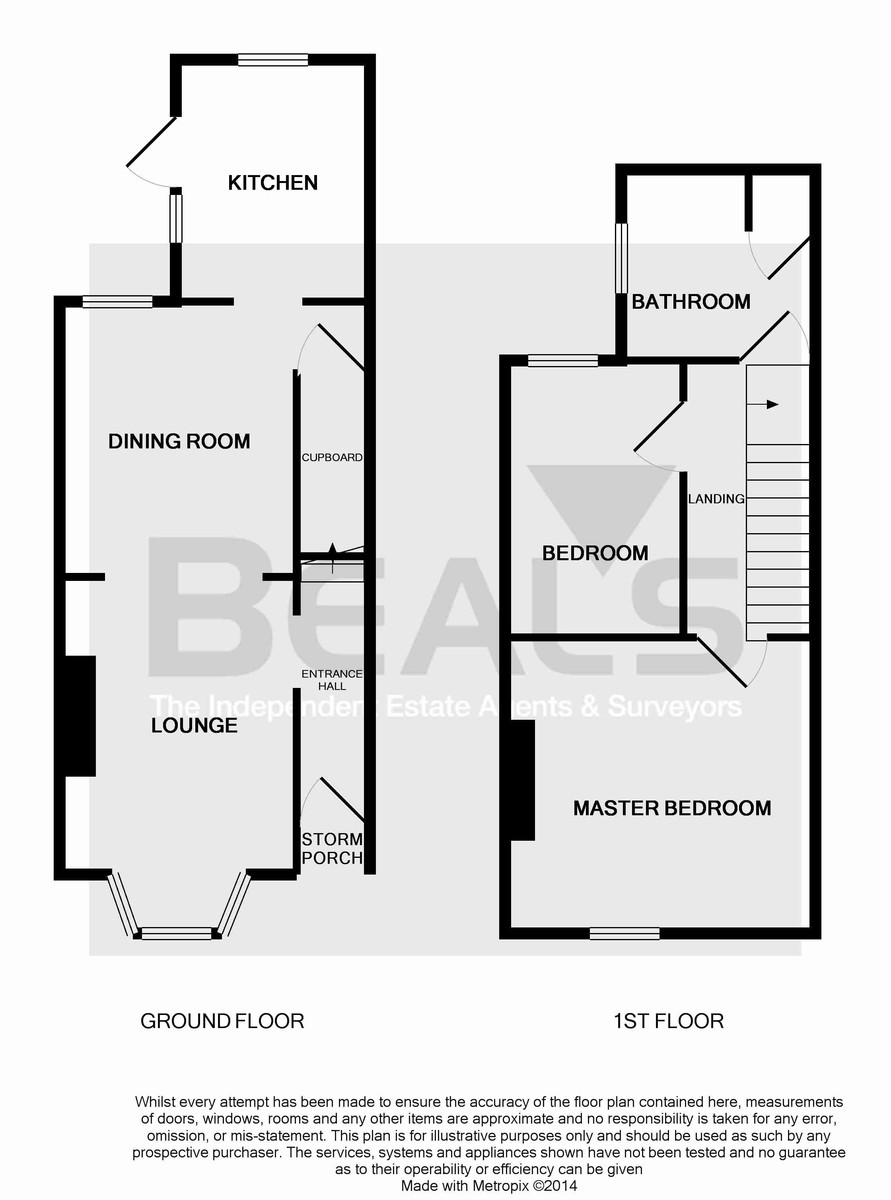

This exceptionally well presented

2 bed Victorian house has just come back on the market after a purchaser withdrew with a £5k reduction in price. The property has undergone full refurbishment to a very high

standard, offering two double bedrooms, large four piece bathroom,

living room, dining room and a stunning fully integrated kitchen. The

property also benefits from UPVC double glazing, gas central heating,

fully insulated and cavity wall insulation. This

desirable location falls in the very popular Shirley Primary School

and Upper Shirley High catchments and is within walking distance to St

James's Park and Southampton General Hospital. Tenant pool will comprise

medical staff and profexxional couples. The property will let well at £925pcm which will return a gross yield

of 5.8% based on the asking price of £190k.

This blog follows the property market in Southampton. You'll find tips, guidance, and analysis that relates specifically to Southampton and you'll also find properties from all the estate agents in the town on here that may make decent investments. I own and operate Belvoir Lettings, a Southampton Letting Agent, and if you're thinking of buying a property to let in Southampton, I'm happy to offer a second opinion.

Search This Blog

Saturday 31 January 2015

Thursday 29 January 2015

Property Eye Candy of the Week

So in the property world, what really floats your boat......!

A Once in a lifetime opportunity to buy an exquisite 90ft Thames Lighter lovingly converted into a luxury House Boat. In a major rebuild 2011/12 'Jason' has been re-plated above and below the waterline including a major topside rebuild which now enables her to boast a single tier upper saloon and fully fitted kitchen with full double glazing offering panoramic views of the stunning River Hamble and Salterns Marshes which are a site of Special Scientific Interest. Below she boasts 3 double bedrooms, 2 bathrooms and an office. The hull is fully insulated and heat is provided by a wood burning stove or electric radiators. The refit means that she should not need to come out of the water for inspection again for approximately 15 years. It really does provide an excellent opportunity to have a unique home - a true floating asset if you will excuse the pun!

Southampton property market up 8.7% in 2014

Hometrack have just released their

latest numbers for December 2014. UK house prices ended the year up 8.3%

according to the Hometrack UK Cities House Price Index. The rate of growth

increased over the year, up from 4.5% in 2013 and 1.1% in 2012. The top 20

cities averaged an impressive 11.3% growth which was clearly aided by London’s

performance, but cities such as Aberdeen, Oxford and Bristol also helped

to improve the average. The poor performers includes Bournemouth, Birmingham,

Glasgow and Liverpool.

Southampton’s numbers are nice

and steady:

Average Value

£190,800

Growth from trough to

date

24.8%

Growth from last peak to date

4.6%

Growth in the last 12

months

8.7%

Growth in the last

Quarter

1.7%

Growth in the last

month

0.6%

Annualising last month’s growth

would still produce an annual return of 7.2% which when combined with a yield

of 5.75% will give overall returns in on almost 13%. This gives a great

platform for long term property investment in the Southampton market. If you

would like more detailed information on the Southampton property market please

drop me a line or call into the office for a coffee and a chat.

https://www.hometrack.com/uk/insight/uk-cities-house-price-index/

Landlords face ticking timebomb of energy compliance

Landlords are at risk of financial penalties and being unable to let

their properties if they fail to meet minimum energy efficiency

standards (MEES) that come into play in 2018.

Law firm Maples Teesdale has warned that the new standards equate to a

ticking time bomb that could have a detrimental impact on rental income

and property values if left unaddressed.

The non-domestic minimum energy efficiency regulations for England and

Wales will mean that by 1 April 2018, all relevant properties will have

to be improved to a minimum energy efficiency standard before being let

to tenants, except where certain exemptions apply.

Additional Tenant’s Energy Efficiency Improvement Regulations must be

in force by 1 April 2016 and will empower tenants to request consent for

energy efficiency measures that may not unreasonably be refused by the

landlord.

Neil Sagoo, partner at Maples Teesdale, said: “These regulations are

likely to have a big impact on the private rented sector. They are

presenting a straightforward ultimatum: bring your properties up to

scratch in terms of energy efficiency, or risk losing income.”

The consequences for landlords who do not invest in bringing their

properties up to minimum standards are likely to be severe. There will

be financial penalties (possibly geared to the rent earned while the

landlord is in breach) applied to those who fail to comply and, in

extreme cases, a tribunal can force landlords to make the necessary

changes.

“This means that landlords can no longer pay lip service to energy

efficiency,” said Sagoo, “Whereas it was once a worthy aspiration, it is

becoming is fundamental as fire safety or building regulations and is

to be ignored at your peril.”

Following a brief consultation at the end of last year, the Government

has indicated that it aims to have the regulations in place ahead of the

May general election. Implementation of MEES is likely to follow in

stages; coming into effect on all new lettings from April 2018 and for

remaining existing lettings from April 2023.

http://www.landlordtoday.co.uk/news_features/Landlords-face-ticking-timebomb-of-energy-complianceSouthampton Landlords is your property up to scratch?

A Darlington landlord has been fined £1,000 for failing to comply with

an Environmental Protection Act Notice served by the council.

The notice served because the property that he rented out was in such a

state that it would put the health of the tenants and any visitors to

the property at risk.

The landlord Kieron Munnelly, of South Street, Derbyshire, pleaded

guilty by post to failing to comply with the notice. He was fined £1,000

for the offence and ordered to pay court costs totalling £500.

The property, on Streatlam Road in Darlington, which was let at the

time to a mother and her three children aged eight and six-years-old and

two months old, had broken heating, draughty windows, damaged light

switches and disrepair to the staircase guarding.

The private sector housing team from Darlington Borough Council visited

the property in March 2014 following a complaint and found that the

tenant and her children had been living in the property without heating

since October 2013 and was having trouble getting the landlord to carry

out the repairs.

The landlord was given every opportunity by the council to carry out

the repairs before the notice was issued. The works were completed in

default of the notice by the council’s building services and the

landlord was charged accordingly. The prosecution case was brought

against Munnelly for failing to comply with the notice.

David Burrell, private sector housing manager, for Darlington Borough

Council said: “Action was taken against a landlord who left his tenants

over winter without adequate heating. The private sector housing team

works hard to protect tenants and ensure that they are able to live in a

safe and warm home.

“It is worth noting that some private tenants depending upon their

personal circumstances may qualify for a free or subsidised price gas

boiler and should contact Warm up North on Free Phone 0800 316 4320 for

further details. Landlords can also make enquires about whether their

tenants and properties qualify for a new boiler.”

Councillor Chris McEwan, Darlington Borough Council’s cabinet member

for economy and regeneration, said: “It is shocking to hear that the

health and wellbeing of a young family has been put at risk. The council

has a duty to act where landlords have failed to provide safe living

conditions for their tenants. Whilst we always try to work with

landlords and help them, action will be taken where they fail to adhere

to legal requirements.”

http://www.landlordtoday.co.uk/news_features/Darlington-landlord-fined-%C2%A31-000-for-cold-homeHMRC investigations into buy-to-let spark surge in tax receipts

Tax investigations – undertaken when officials believe there is evidence of

underpayment – are resulting in record hauls of capital gains tax.

Failures by owners of buy-to-let property to declare gains and pay the

appropriate tax are believed to be behind the trend. Figures obtained by a

firm of accountants show HM Revenue & Customs’ tax inspectors obtained

£136m as a result of probes into underpayments of capital gains tax for the

year 2013-14. This marks a 24pc increase from the previous year, when £110

million was collected.

The sharp upsurge has been pinned on the taxman putting increased resource

into stepping up its scrutiny of private landlords.

Soaring property prices has helped fuel bigger profits for buy-to-let

investors in recent years and the revenue suspects tens of thousands are

unaware of the tax due, or are bending the rules and understating their

capital gains, according to Mark Giddens, a tax partner at UHY Hacker Young,

the accountancy group which obtained the data.

“The change in the mood music at HMRC means that property investors are now

firmly in the crosshairs for tax investigations,” Mr Giddens said.

“There are a significantly greater number of buy to let landlords and private

property investors in the UK than was the case 10 years ago, and they make

tempting targets.”

Fewer than 500,000 taxpayers are registered with HMRC as owning second properties. The taxman estimates that the true number of landlords is much higher, at around 1.5 million, and wants to close the gap.

HMRC has been very public about its clampdown on landlords. It has run a number of campaigns warning those who fail to pay sufficient tax on either rental income or capital gains.

Last August the taxman sent 40,000 letters to landlords it suspected were bending tax rules.

The letters warned landlords to put their affairs in order or else run the risk of a large fine or a criminal investigation.

In general the capital gains tax take is growing strongly, driven both by rising shares and property prices. According to the latest figures from the Office for Budget Responsibility the CGT take for 2012-13 was £3.9bn. It is estimated to rise to £6.7bn in 2015-16 and reach £9bn by 2018-19.

Rising property prices are not the only driver of the trend: changes introduced by the Government relating to second properties will also increase the CGT take over time. The main change so far relates to second properties the owner formerly lived in.

Owners’ main homes are free of capital gains tax as long as they remain their main home – but under another concession, a property that was once a main home is also free of capital gains tax for the last three years of ownership.

To take advantage of the loophole some homeowners “flipped” the classification of their main and second residences so they could limit eventual tax. Last year this “grace period” was halved to 18 months.

It is now very difficult for landlords to limit capital gains tax. David Lawrenson of Lettingfocus.com, a website for landlords, said: “Under previous tax regimes landlords had taper relief and other reliefs which took some account of inflation. There are no reliefs available now that take inflation into account.”

A spokesman for HMRC said: “Our enquiries are extremely effective as these figures show.”

http://www.telegraph.co.uk/finance/personalfinance/tax/11335872/HMRC-investigations-into-buy-to-let-spark-surge-in-tax-receipts.html

Tuesday 27 January 2015

Southampton property auction season kicks off in two weeks

The auction season kicks off on the 11th of February with Clive Emson auction taking place in the Ageas Bowl www.cliveemson.co.uk and with Fox and Sons auction on the following day in the Botley Park Hotel www.foxandsonsauctions.co.uk.

Fox and Sons have this freehold investment property in Shirley and are guiding £125k

Fox and Sons have this freehold investment property in Shirley and are guiding £125k

This semi detached property was converted in the late 1980's into 2 x 1 bedroom apartments and is well located for access to Shirley High Street and its

excellent amenities. Regular bus services pass along Shirley High

Street,central Southampton and the General Hospital are just a short drive away. Planning was approved for this conversion on 15th February 1989.The ground floor flat is let at £465pcm and the first floor flat at £505pcm. Total annual income is £11,640 and Gross Yield 9.3%.

The property offers a lot of potential to refurb with a potential rental income of £15,000.

Clive Emson has this freehold semi on Malmesbury Rd, Shirley for auction guiding £150k / £160k

The property has been converted to provide two studio rooms with

shared facilities and a self-contained one bedroom flat. The property is well located in a popular letting area and would suit continued use as a letting

investment, alternatively conversion back to a single dwelling, or for

further development, subject to all necessary consents being obtainable could be considered. Current rental income is £11,880 which produces a gross yield of c7.7% . A conversion to two 1 bed units could produce an income of £15,000 ( subject to consent ).

These are well located properties that will attract strong tenant demand. We can't get enough good 1 bed units which will easily let at the £600 to £625pcm level. If you fancy getting your hands dirty they could be for you!

Housing market creeps up in ‘new year bounce’

The housing market is showing signs of a “new year bounce” in

activity, with new sellers increasing asking prices by an average of

nearly £4,000 in January, property search website Rightmove has

reported.

The price of property coming on the market increased by 1.4% or £3,798 compared with December - despite January usually being a month when asking prices fall, the website said.

Across England and Wales, the average asking price for a property put on the market this month is £273,275, which is 8.2% higher than a year ago.

Rightmove said that while it is still early days, “there are signs of a new year bounce-back”, with visits to the website this year so far running at 10% higher than a year ago.

Meanwhile, people looking to take their first step on the property ladder have the opportunity to grab a cheaper deal this month, the website’s findings suggest. Sellers of typical first-time buyer homes are asking for around £1,132 less than they were in December.

The average asking price on a first-time buyer property is now £163,251, although this is still a significant 10.5% increase on a year ago.

Rightmove said that the recent reforms to stamp duty, which have made the tax bill less expensive for the vast majority of homebuyers, could mean potential savings of as much as £1,250 for a first-time buyer.

Miles Shipside, director of Rightmove, said: “First-time buyers are in a potential win win savings window this month, with the price of property coming to market in this sector being over £1,100 cheaper, coupled with up to £1,250 in stamp duty savings.”

In further signs that the wider market is showing an early pick-up in 2015, Rightmove said it had more than 52m page views on Sunday 11 January, marking a record for the website.

It

said that the signs of increased interest in homes for sale, combined

with estate agents reporting low stocks of property on the market in

popular locations, is likely to create a further upward pressure on

prices in desirable areas.

Shipside said these signs of “early bird activity” in 2015 could be a result of the stamp duty changes which were unveiled in December and are expected to encourage more people to move home.

But he continued: “Rightmove still cautions sellers that it will be harder to sell in 2015 than in 2014.”

He said that the looming general election could cause some disruption to the market. Meanwhile, mortgage lenders are showing signs of introducing more selective criteria - and this could mean that buyers who are able to pass the criteria and secure a mortgage will be more fussy about the home they buy, he said.

Shipside said: “Buyers deemed mortgage-worthy will value their hard-won purchase pots and want to spend them wisely.

“That might mean stretching themselves to afford a property that ticks all the boxes, but wanting a heavy discount on one that falls short.”

Rightmove’s figures show that asking prices in London have seen the highest year-on-year increase, at 12.8%, pushing the average price to £566,404. The South West of England has recorded the biggest month-on-month jump in asking prices, with a 3% increase taking the typical price to £267,623.

The north-east of England recorded both the lowest year-on-year increase in sellers’ asking prices and the biggest month-on-month dip. Prices in the north-east stand at £135,055, on average, marking a 0.8% increase on a year ago and a 1.7% month-on-month decrease.

Simon Gerrard, president of the National Association of Estate Agents and managing director of Martyn Gerrard Estate Agents with 11 branches in London, said: “Overall, I think we’ll see a strong first quarter to the year, especially as potential buyers are now getting used to what is expected of them with the stricter lending criteria.”

http://www.theguardian.com/money/2015/jan/19/housing-market-up-new-year-bounce-property?CMP=EMCMONTXT5510I2The price of property coming on the market increased by 1.4% or £3,798 compared with December - despite January usually being a month when asking prices fall, the website said.

Across England and Wales, the average asking price for a property put on the market this month is £273,275, which is 8.2% higher than a year ago.

Rightmove said that while it is still early days, “there are signs of a new year bounce-back”, with visits to the website this year so far running at 10% higher than a year ago.

Meanwhile, people looking to take their first step on the property ladder have the opportunity to grab a cheaper deal this month, the website’s findings suggest. Sellers of typical first-time buyer homes are asking for around £1,132 less than they were in December.

The average asking price on a first-time buyer property is now £163,251, although this is still a significant 10.5% increase on a year ago.

Rightmove said that the recent reforms to stamp duty, which have made the tax bill less expensive for the vast majority of homebuyers, could mean potential savings of as much as £1,250 for a first-time buyer.

Miles Shipside, director of Rightmove, said: “First-time buyers are in a potential win win savings window this month, with the price of property coming to market in this sector being over £1,100 cheaper, coupled with up to £1,250 in stamp duty savings.”

In further signs that the wider market is showing an early pick-up in 2015, Rightmove said it had more than 52m page views on Sunday 11 January, marking a record for the website.

Advertisement

Shipside said these signs of “early bird activity” in 2015 could be a result of the stamp duty changes which were unveiled in December and are expected to encourage more people to move home.

But he continued: “Rightmove still cautions sellers that it will be harder to sell in 2015 than in 2014.”

He said that the looming general election could cause some disruption to the market. Meanwhile, mortgage lenders are showing signs of introducing more selective criteria - and this could mean that buyers who are able to pass the criteria and secure a mortgage will be more fussy about the home they buy, he said.

Shipside said: “Buyers deemed mortgage-worthy will value their hard-won purchase pots and want to spend them wisely.

“That might mean stretching themselves to afford a property that ticks all the boxes, but wanting a heavy discount on one that falls short.”

Rightmove’s figures show that asking prices in London have seen the highest year-on-year increase, at 12.8%, pushing the average price to £566,404. The South West of England has recorded the biggest month-on-month jump in asking prices, with a 3% increase taking the typical price to £267,623.

The north-east of England recorded both the lowest year-on-year increase in sellers’ asking prices and the biggest month-on-month dip. Prices in the north-east stand at £135,055, on average, marking a 0.8% increase on a year ago and a 1.7% month-on-month decrease.

Simon Gerrard, president of the National Association of Estate Agents and managing director of Martyn Gerrard Estate Agents with 11 branches in London, said: “Overall, I think we’ll see a strong first quarter to the year, especially as potential buyers are now getting used to what is expected of them with the stricter lending criteria.”

Monday 26 January 2015

You got to laugh - German landlord taking the p*!?

UK landlords are often criticised for withholding tenants’ deposits for

all kinds of unfair reasons but a landlord in Germany has ended up in

court for trying to claim damage caused by urine.

The landlord was seeking €1,900 (£1,400) for damage to a marble floor

caused by a male tenant missing the toilet bowl while urinating standing

up.

There is some debate in Germany about whether men should sit or stand

to pee but Judge Stefan Hank in Duesseldorf backed the tenant’s right to

urinate standing up.

Some German toilets have red traffic-style signs forbidding the

standing position - but those who choose to sit are often referred to as

a "Sitzpinkler", implying it is not masculine behaviour.

The judge agreed with an expert's report that uric acid had caused some

damage to the bathroom's floor but said men who stand cannot be held

account for “collateral damage”.

Men: It would make life easier all round if you just cleared up after yourselves.

http://www.landlordtoday.co.uk/news_features/German-landlord-taking-the-p*!Saturday 24 January 2015

2 bed freehold house close to Southampton Hospital yields 5.5%

This two bed semi-detached house has loads of character. It

has been upgraded and refurbed over the years including a modern kitchen and

bathroom. The rear garden is a lovely feature perfect for the summer BBQ's. The

only real negative is the lack of off street parking however permit parking is

available on street. The unit will appeal to a wide tenant pool including

professionals, corporates and medical staff in the hospital which is c0.5 miles

away. Rental wise you will achieve around £850 pcm which will produce a gross yield

of 5.5% and it will let well with minimum voids. Worth a look if you want to

stay away from the leasehold units!

Subscribe to:

Posts (Atom)