The value of all the homes in Southampton has

risen by more than 247% in the past two decades, to £18.927bn, meaning its

worth more than the publicly quoted company BAE Systems, which is only worth £18.237bn!

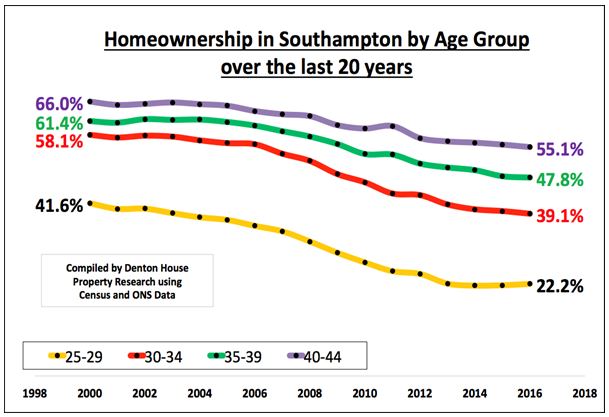

Those Southampton homeowners and Buy-to-Let landlords

who bought their homes twenty or more years ago have come out on top, adding

thousands and thousands of pounds to the value of their own Southampton homes

as the younger generation in Southampton continue to be priced out of the

market. This is even more remarkable

because, in those twenty years, we had the poor years of 2008 and 2009

following the global financial crisis, where we saw a short term drop in Southampton

house prices of between 15% and 20% (depending on the type of property). And thankfully

given that there have been a number of consecutive years of growth in property

values recently in Southampton, we are now well above the 2007 levels in most

cases.

Twenty years ago, the total

value of Southampton property was worth £5.442bn. Over those twenty years,

total property values have increased by £13.485bn( a 247% increase) meaning today, the total value of all the

properties in Southampton is worth £18.927bn. Even more remarkable, when you consider the FTSE100 has

only risen by 40.84% in the same time frame. Also, when I compared it with

inflation, i.e. the UK Retail Price Index, inflation had risen by 72.2% during

the same twenty years.

So, what does this all mean for Southampton? Well as we move through the unchartered

waters of 2018 and beyond, even though property values are already declining in

certain parts of the previously over cooked central London property market, the

outlook in Southampton remains relatively good as over the last five years, the

local property market has been a lot more sensible than central London’s.

Southampton house values will remain resilient for several

reasons. Firstly, demand for rental property remains strong with persistent immigration and population

growth. Secondly, with 0.5% interest

rates, borrowing is still cheap and finally, the simple lack of new house

building in Southampton. Not even keeping up with current demand, let alone

eating into years and years of under investment mean only one thing – yes it might

be a bumpy ride over the next 12 to 24 months but, in the medium term, property

ownership and property investment in Southampton has and always will, ride out

whatever dark clouds are on the horizon.

If you are looking for an agent that is well established, professional andcommunicative, then contact us to find out how we can get the best out of your investment property.

Email me on brian.linehan@belvoirlettings.com or call on 023 8001 8222.

Don't forget to visit the links below to view back dated deals and Southampton Property News.

Twitter, https://twitter.com/sotonbelvoir

LinkedIn, https://www.linkedin.com/in/brianlinehan

LinkedIn, https://www.linkedin.com/in/brianlinehan