There is no escaping the fact that over the last couple of

decades, the rise in the number buy to let properties in Southampton has been

nothing short of extraordinary. Many in

the “left leaning” press have spoken of a broken nation, the fact many

youngsters are unable to buy their first home with the rise of a new cohort of

younger renters, whom have been daubed ‘Generation Rent’ as landlords hoover up

all the properties for their buy to let property empires. Government has been

blamed in the past for giving landlords an unfair advantage with the tax

system. It is also true many of my fellow professionals have done nothing to

avail themselves in glory, with some suspect, if not on some rare occasions, downright

dubious practices.

Yet has the denigration and unfair criticism of some Southampton

landlords gone too far?

It was only a few weeks ago, I read an article in a

newspaper of one landlord who had decided to sell their modest buy to let portfolio

for a combination of reasons, one of which being the new tax rules on buy to

let that were introduced last year. The comments section of the newspaper and

the associated social media posts were pure hate, and certainly not deserved.

Like all aspects in life, there are always good (and bad)

landlords, just like there are good (and bad) letting agents ... and so it

should be said, there are good tenants and in equal measure bad tenants. Bad

letting agents and bad landlords should be routed out … but not at the expense

of the vast majority whom are good and decent.

But are the 9,872 Southampton portfolio buy to let landlords

at fault?

The Tories allowed people to buy their own Council house in

the 1980’s, taking them out of the collective pot of social rented houses for

future generations to rent them. Landlords have been vilified by many, as it has

been suggested by some they have an unhealthy and ravenous avarice to make cash

and profit at the expense of poor renters, unable to buy their first home. Yet,

looking beyond the headline grabbing press, this is in fact ‘fake news’. There

are seven reasons that have created the perfect storm for private renting to

explode in the 2000’s.

To start with, the Housing Acts of 1988 and 1996 gave buy to

let landlords the right to remove tenants after six months, without the need

for fault. The 1996 Act, and its changes, meant banks and building societies could

start to lend on buy to let properties, knowing if the mortgage payments

weren’t kept up to date, the property could be repossessed without the issue of

sitting tenants being in the property for many years (even decades!) ... meaning

in 1997, buy to let mortgages were born… and this, my blog reading friends, is

where the problem started.

Secondly, in the early 2000’s, those same building societies

and banks were relaxing their lending criteria, with self-certification (i.e. you did not need to prove your income),

mortgages 8 times their annual salary, and very helpful interest only mortgage deals

helped to keep repayments inexpensive.

Thirdly, the totally inadequate building of Council Houses (aka

Local Authority Housing) in the last two decades and (so I’m not accused of Tory bashing) - can you believe Labour only

built 6,510 Council Houses in the WHOLE OF THE UK between 1997 and 2010? Giving

the Tories their due, they have built 20,840 Council Houses since they came to

power in 2010 (although still woefully low when compared the number of Council

Houses built in the 1960’s and 1970’s when we were building on average 142,000

Council Houses per year nationally). This meant people who would have normally

rented from the Council, had no Council House to rent (because they had been

bought), so they rented privately.

And then 3rd, 4th, 5th, 6th

and 7th …

·

Less of private home building (again look at the

graph) over the last two decades.

·

A loss of conviction in personal pensions

meaning people were looking for a better place to invest their savings for

retirement.

·

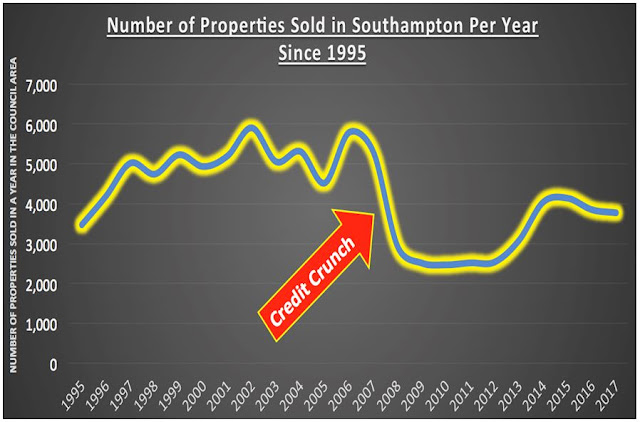

Ultra-low interest rates for the last nine years

since the Credit Crunch meaning borrowing was cheap.

·

A massive increase in EU migration from 2004,

when we had eight Eastern European countries join the EU. That brought 1.4m

people to the UK for work from those countries – and they needed somewhere to

live.

Thus, we got the perfect storm conditions for an eruption in

the Southampton Private Rented Sector.

Commercially speaking, purchasing a Southampton property has

been undoubtedly the best thing anyone could have done with their hard-earned

savings since 1998, where property values in Southampton have risen by 269.56%...

…and basing it on the average rental in Southampton, earned £226,368

in rent.

Yet, the younger generation have lost out, as they are now incapable

of getting on to the property ladder(especially in Central London).

The Government have over the last few years started to

redress the imbalance, increasing taxes for landlords, together with the Banks

being tighter on their lending criteria meaning the heady days of the Noughties

are long gone for Southampton landlords. In the past 20 years, anything but

everything made money in property and it was easy as falling off a log to make

money in buy to let in Southampton – but not anymore.

Being a letting agent has evolved from being a glorified

rent collector to a trusted advisor giving specific portfolio strategy planning

on each landlord’s buy to let portfolios. I had a couple of instances recently with

a couple of portfolio landlords, one from Curdridge who

wanted income in retirement from his buy to let’s and the other from Chilworth,

who wanted to pass on a decent chunk of cash to his grandchildren to enable

them to buy their own home in 15/20 years’ time.

Both of these landlord’s portfolios were woefully going to

miss the targets and expectations both landlords had with their portfolios, so

over the last six/nine months, we have sold a few of their properties,

refinanced and purchased other types of Southampton property to enable them to

hit their future goals (because some properties in Southampton are better for

income and some are better for capital growth) ... And that my blog reading

friends is what ‘portfolio strategy

planning’ is!

If you think you need ‘portfolio strategy planning’, whether

you are a landlord of ours or not (because the Chilworth landlord wasn’t) ... drop me line or give the office a call.

Thank you for reading.

If you are looking for an agent that is well established, professional andcommunicative, then contact us to find out how we can get the best out of your investment property.

Email me on brian.linehan@belvoirlettings.com or call on 023 8001 8222.

Don't forget to visit the links below to view back dated deals and Southampton Property News.

Twitter, https://twitter.com/sotonbelvoir

LinkedIn, https://www.linkedin.com/in/brianlinehan

LinkedIn, https://www.linkedin.com/in/brianlinehan