The

number of residential property transactions in Southampton will be 3.1 per cent

higher in 2018, compared to 2017.

The

number of residential property transactions in Southampton will be 3.1 per cent

higher in 2018, compared to 2017.

According to my

research, the seasonally

adjusted statistics for our local authority area suggest with the number of

properties already sold in 2018, and the number of properties currently under

offer or sold subject to contract (allowing for property sales to fall through

before exchange of contracts) we, as an area, will end the year 3.1 per cent higher

compared to 2017.

So why are transaction numbers so

important to Southampton homeowners, Southampton landlords and potential

first-time buyers?

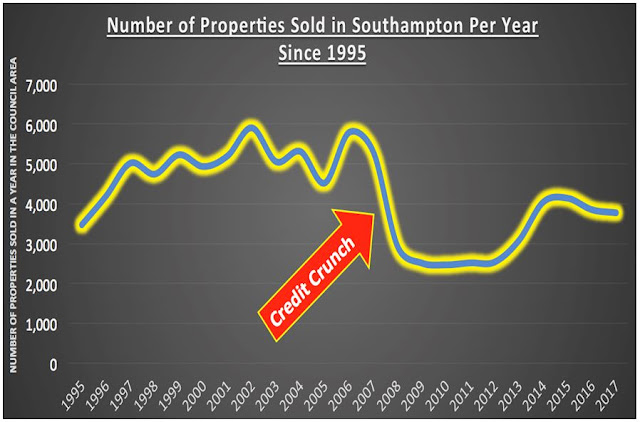

Many economists and property market

commentators believe transaction numbers give a more precise and truthful

indicator of the health of the property market than just house values. In the

six years before the Credit Crunch in 2007/8, the

average number of completed property transactions in the local area (the local

authority covered by Southampton) stood at 5,293 per year .. yet in the three

years following the Credit Crunch, on average, only 2,496 homes were changing

hands per year in the area.

Roll the clock forward to more

recent times and last year, in 2017, 3,771 homes changed hands (i.e. transacted and sold) in the area,

not far off the local authority’s 23 year overall average of 4,193 homes per

year.

In the past, a reduction in the number of properties selling has often been believed to be the first signal of a down turn in the housing market as a whole. Although, the down turn of the credit crunch years (2007/2008) was more a free-fall than a subtle down turn. Look at the graph and the ‘so-called’ halcyon days of the 2000 to 2006 property market were a roller coaster when it came to the number of transactions. House prices were rising in the six/seven years before the credit crunch (2000 to 2006), albeit, the rate of growth of Southampton house prices did slow in late 2005 and 2006 (which does fit in nicely with the graph).

In other articles, I have mentioned the

change in the number of houses for sale today compared to last year and further

back. Although, the market has seen in recent months (i.e. the short term) an increase in the number of properties for

sale, fundamentally, in the medium term, there has been an underlying trend in

the reduction of properties coming onto the market for sale in Southampton (and

nationally) and this has been one of the main drives behind the lack of

properties selling .. Southampton people aren’t moving as much as they were 30

years ago meaning fewer houses are selling each year.

However, this short-term increase in

properties for sale hasn’t been even across the board. In certain sectors of

the Southampton property market, there is a glut of properties on the market at

the moment and so prices and values are dropping on those types as sellers

compete for the limited amount of buyers… yet, there are other sectors of the Southampton

property market where there is a dearth, a shortage of property, and buyers are

fighting tooth and nail with silly offers to try and secure the sale. This

means, there are some bargains for you Southampton buy to let landlords. If you

look hard enough, you could spot the same trends I have seen in Southampton and

find the individual property micro markets that fall into that first sector (with

its glut).

So, if you want the inside track on the Southampton

property market, whether you are a landlord of ours or another agent, I am more

than happy to guide you in the right direction if you drop me a line or an

email (contacts details are easily found on this page – and I don’t bite or do

hard sell – promise!).

So, to conclude, I believe we will

finish on 3,888 housing transactions by the end of the year in the area .. higher

than last year’s figure and not too far off the long-term 23-year average. Looking

at the short term future, now it’s true some (not all) but some potential

purchasers of property in Southampton may be exhibiting more caution because of

concerns that the Bank of England will continue to put up interest rates– to

which I reply – yes of course they will when they are only ultra-low at 0.75%.

Anyway, that is the reason why 90%+ of new mortgages over the last nine months

have been on a fixed rate. Also, if they do go up a few percentage points –

they are nothing compared to the 12%, 14%, even 15% mortgage rates many of my

landlords saw in the early 1990’s.

We can all speculate (and I appreciate

the irony of that as I write this article) but all I say to any Southampton

landlords, Southampton homeowners or Southampton first time buyers is act

according to your own life cycle, budget on a modest increase in interest rates

in the coming few years (yet protect yourself by fixing it), consider your own circumstances

and finally, what you can afford.

If you are thinking of selling your Southampton home or if you are a Southampton landlord, hoping to sell your buy to let property (with tenants in), either way, if you want a chat to ensure you get a decent price with minimal fuss ... drop me a message or pick up the phone.

If you are looking for an agent that is well established, professional andcommunicative, then contact us to find out how we can get the best out of your investment property.

Email me on brian.linehan@belvoirlettings.com or call on 023 8001 8222.

Don't forget to visit the links below to view back dated deals and Southampton Property News.

Twitter, https://twitter.com/sotonbelvoir

LinkedIn, https://www.linkedin.com/in/brianlinehan

LinkedIn, https://www.linkedin.com/in/brianlinehan

No comments:

Post a Comment